Experiencing extensive damages to your home and learning that your house needs a roof repair or a roof replacement is never good news for any homeowner.

Apart from dealing with the problem itself, finding a reliable roofer, and setting aside a substantial amount of money for it, there is also the insurance claim process.

Filing an insurance claim is one of the more complicated tasks and the process is known to be very stressful for the homeowners. There is even a great number of people that don’t file the claim simply due to all the complexities that follow it.

However, your insurance policy is there to cover you precisely in the case of some roof damaging event. You shouldn’t be discouraged by the amount of paperwork you will need to supply or by the meticulous roof inspections that insurance companies will conduct.

We are here to make the process as easy as possible, give you some tips, and help you prepare properly.

Always Be Aware of What Your Policy Covers

Insurance policies may vary from company to company, as well as from roof to roof.

Naturally, all insurance policies will have their own stipulations and requirements, as well as the extent of damages they cover.

Some may not completely cover roofs older than 10 years, for example, and others may require you to file your claim a certain number of days after the damage has happened.

In any case, you should be aware of what kind of policy you have, so that you are ready when and if the disaster strikes. You don’t want to be a day late on your insurance claim process and risk not receiving full or any payment to cover your repair costs.

Inspect and Document the Damage as Soon as Possible

When we say as soon as possible, we don’t mean while the storm or the wind is still strong and in progress. It is very important to stay safe and wait for the weather to die down so that you can assess the damage.

If you notice any obvious damage to your roof, make sure to take some photos as you are most likely going to file an insurance claim.

Having everything documented and in black and white is the best way to avoid any confusion or possible contention by the insurance company.

Record videos, take photos and try to capture every detail. If you have any pictures of your roof before the storm and the damages, it will help significantly in assessing the damage and comparing the before-and-after situation.

The damages, on the other hand, are not always easily visible, especially from the ground level. Some may require going up the ladder or on the rooftop to get a better view, which we do not recommend doing as it is not safe.

In this case, we highly recommend calling a professional and experienced roofer your trust to come and inspect your roof. They can also provide you with an estimate and do the necessary repair work, but more about that later on.

Call Your Insurance Company

Once you’ve documented everything as best as you could, it is time to contact your insurance company. You can call them on the phone, describe everything as thoroughly as possible, or you can send them an email with the photos you took.

It is best to contact them as soon as you can after the damage has occurred so that you can get the process started and find out what your next steps are.

Your policy may even stipulate that you have to call your insurance company within a certain period of time.

We recommend being as prepared and as focused as you can when contacting them: have your insurance policy number at hand, answer all their question in detail, and provide them with the results of the professional roof inspection if you’ve already had one, which we will cover next.

Get a Roofing Estimate

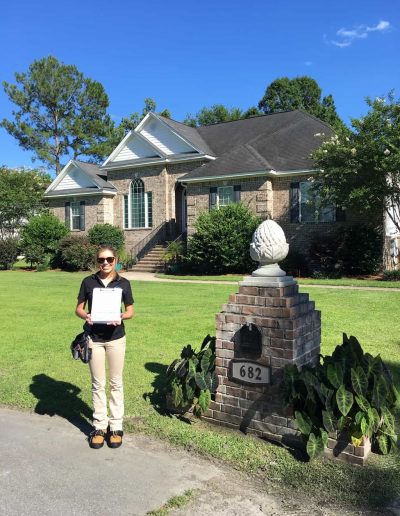

Once you’ve contacted the insurance company, they will most likely send their representative, an insurance adjuster, to come asses and inspect your roof.

The smart thing to do before the adjuster comes is to call a roofer to get a professional estimate, which you can later compare with the adjuster’s estimate, especially if they try to undervalue your claim.

The insurance company may also stipulate in your policy that a roofer of their own choosing should come and inspect your roof or even repair the damage.

In this case, it is also advisable to get an estimate from an independent roofing company, one that you trust or that you’ve worked with before, so that you can compare the estimates and get a better understanding.

Be Home When the Insurance Adjuster Comes

Even though it is not always necessary for you to be there when the adjuster comes, we definitely advise that you be there.

As they will sometimes try to devalue some of the damages, lower you claim, or reimburse you for less than you are entitled to, you need to be there to point out all the damages, ask as many questions as you can, and try to get full coverage for the damage.

You will have your photos, your policy, your professional estimate, so make sure to bring all of it to the adjuster’s attention.

Prepare to Negotiate

In an ideal situation, your insurance company will reimburse you for all the damages your roof has experienced, covering the needed roofing repairs.

However, that may not always be the case, which is why you need to be ready to negotiate a little.

The first rule is not to take the first offer – if you have a valid reason, of course – because that is what the insurance company expects and hopes for.

This is where all your documentation, notes, professional estimates, and photos come in handy, as you can use them to negotiate a better offer, i.e. better financial coverage.

Enlist the Help of a Reliable Roofer

Finally, if you find it too hard, stressful or complicated to deal with your insurance company and file an insurance claim on your own, you can always enlist the help of a professional roofing company.

If the insurance company lets you use your own roofer for roof repairs, then you can even let them handle the entire insurance claim process.

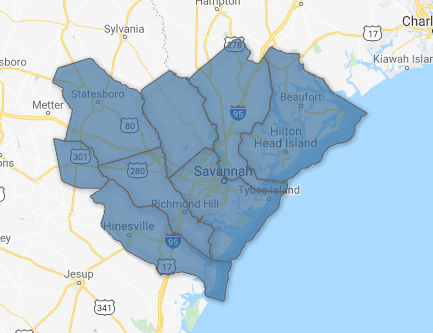

Find a trustworthy roof repair contractor that is experienced in dealing with insurance claims, that has a great track record with them, and that will efficiently repair your roof in the end.